All Categories

Featured

There is no one-size-fits-all when it comes to life insurance coverage./ wp-end-tag > In your active life, financial self-reliance can seem like an impossible goal.

Fewer companies are providing conventional pension plan strategies and several business have reduced or stopped their retirement strategies and your ability to depend only on social protection is in concern. Also if benefits haven't been reduced by the time you retire, social security alone was never ever planned to be enough to pay for the way of life you desire and deserve.

/ wp-end-tag > As component of an audio financial method, an indexed global life insurance policy can help

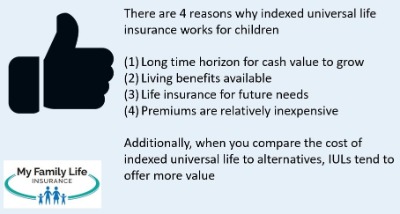

you take on whatever the future brings. Before dedicating to indexed universal life insurance policy, here are some pros and cons to think about. If you pick a great indexed universal life insurance policy strategy, you may see your cash money value grow in worth.

Nationwide Yourlife Indexed Ul Accumulator

If you can access it early on, it may be useful to factor it into your. Considering that indexed global life insurance policy requires a specific degree of danger, insurer often tend to maintain 6. This kind of strategy also supplies (tax free retirement iul). It is still ensured, and you can readjust the face amount and riders over time7.

Finally, if the picked index doesn't perform well, your cash money worth's development will certainly be impacted. Commonly, the insurance coverage firm has a beneficial interest in doing better than the index11. There is typically an assured minimum interest price, so your plan's growth won't fall listed below a particular percentage12. These are all variables to be thought about when picking the very best sort of life insurance for you.

Flexibility Of Universal Life

Given that this kind of policy is more complicated and has an investment component, it can usually come with greater costs than various other plans like whole life or term life insurance. If you do not assume indexed universal life insurance policy is right for you, below are some options to consider: Term life insurance policy is a short-lived policy that generally uses insurance coverage for 10 to thirty years.

Indexed universal life insurance policy is a kind of plan that supplies more control and adaptability, together with greater cash worth growth capacity. While we do not use indexed global life insurance policy, we can give you with even more information about entire and term life insurance policy plans. We suggest checking out all your alternatives and chatting with an Aflac representative to discover the most effective fit for you and your family members.

The rest is included in the cash money value of the policy after fees are subtracted. The cash money worth is credited on a regular monthly or annual basis with rate of interest based on rises in an equity index. While IUL insurance coverage might show beneficial to some, it is necessary to recognize how it functions prior to purchasing a plan.

Latest Posts

Term Insurance Vs Universal Life

Nationwide Indexed Universal Life Accumulator Ii

Iul Vs Term